Online Personal Loan Eligibility Calculator

Easily calculate your personal loan eligibility and EMI in minutes. Plan your loan better by knowing exactly how much you can borrow based on your income, current obligations, and repayment capacity.

What is a Personal Loan Eligibility Calculator?

A Personal Loan Eligibility Calculator is an intelligent online tool that helps you assess your eligibility for a personal loan. It uses your financial inputs, such as monthly income, existing EMIs or obligations, and preferred loan tenure to give you an estimate of how much loan amount you can get, and what your monthly EMI would look like. Whether you're planning to consolidate debt, fund a wedding, handle medical expenses, or make a large purchase, the calculator ensures you borrow smart.

Required Loan Amount

Required Tenure

Net Monthly in-hand Salary

Other Existing EMIs (Monthly)

Credit Score

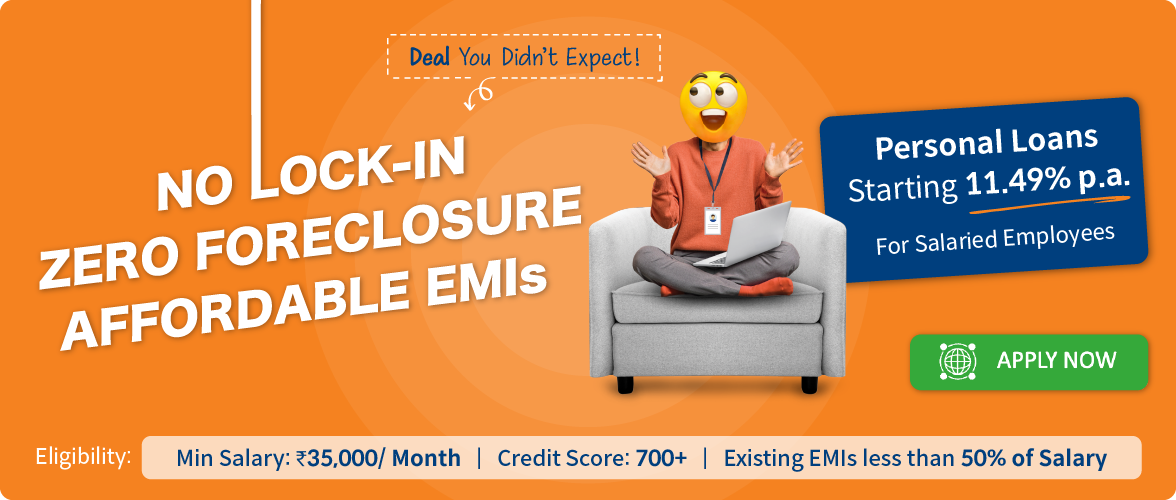

Note: Only salaried

individuals are eligible.

Eligibility is not a guarantee. Eligibility will be checked based on the information you

provide. The amount you can borrow (loan amount), the repayment period (tenure), and the

interest rate will vary depending on your credit profile, employment info, and salary

details.Eligibility is not a guarantee. Interest of 11.49% p.a. is considered to calculate

the loan amount.

How to use Personal Loan Eligibility Calculator?

The Personal Loan Eligibility Calculator is designed to help you understand your loan affordability before you apply. By entering a few key details, you can quickly determine your loan eligibility, expected EMI, and make better financial decisions.

To get accurate results, the calculator considers the following essential inputs:

Loan Amount

Start by entering the amount you wish to borrow. This helps the calculator estimate what EMI you would need to pay based on your income, interest rate, and tenure. Whether you need ₹50,000 or ₹15 lakhs, entering the desired loan amount helps you compare how it fits into your monthly budget. If the EMI for your chosen loan amount exceeds your eligible EMI, you’ll know it's time to adjust either the amount or tenure.

Loan Tenure

Loan tenure refers to the duration over which you plan to repay your loan. Most personal loans offer flexible tenure ranging from 12 months to 60 months (1 to 5 years). A longer tenure results in lower monthly EMIs, making it easier on your budget. However, longer tenure also increases the total interest paid over time. Conversely, a shorter tenure means higher EMIs but less overall interest.

Key Insight: Longer tenure → Lower EMI → Higher eligible loan amount. By adjusting the tenure, you can find the right balance between EMI affordability and interest costs.

Net Monthly Salary

Your net monthly income (income after deductions like tax, provident fund, etc.) is one of the most important factors that determine your personal loan eligibility. Lenders typically allow your total EMIs (existing + new) to be 40–50% of your net income. This ensures you can comfortably repay without financial stress.

Example:

If your take-home salary is ₹60,000, you may be eligible to pay an EMI of up to ₹24,000–₹30,000.

Entering your income helps the calculator determine the maximum EMI you can afford — and from that, it calculates your eligible loan amount.

Existing Obligations

Your ongoing EMIs — such as home loans, car loans, education loans, or credit card dues — significantly affect your eligibility. The more you owe, the less room there is for a new EMI. This is where the concept of FOIR (Fixed Obligations to Income Ratio) comes in. Lenders subtract your existing EMIs from your income before calculating your loan eligibility.

Lower obligations = higher loan eligibility

Example:

If you earn ₹60,000 and already pay ₹10,000 in EMIs, your available income for a new EMI becomes ₹50,000. Based on this, your eligible EMI might be around ₹20,000–₹25,000.

Key Insight: Lower existing EMIs → chance of a higher loan. Managing existing EMIs smartly can directly boost your loan eligibility.

Credit Score

Your credit score is a key factor in determining not just eligibility, but also the interest rate offered by the lender. a score of 750 or above is considered excellent and may qualify you for better loan terms. a lower score may result in reduced loan amounts or higher interest rates — or even rejection. although the calculator may not require your exact credit score, you should check it beforehand to understand your approval likelihood.

Tip: Regularly check your credit report for errors and maintain a clean repayment history to boost your score.

Interest Rate

Interest rate determines the cost of borrowing. While our calculator may use an average rate (say, 12% p.a.), your actual rate may differ based on your credit profile.

Key Insight: Interest rates aren’t one-size-fits-all — better credit history often means lower rates, reducing your cost of borrowing.

How Is Personal Loan Eligibility Calculated?

The calculator uses a formula based on your FOIR (Fixed Obligations to Income Ratio), which lenders use to assess risk. Typically, lenders prefer FOIR under 50%.

EMI Eligibility = (Net Monthly Income – Existing EMIs) × FOIR%

Then, based on the resulting EMI, the personal loan amount is calculated using the reverse EMI formula.

Example Calculation

Net Monthly Income

₹ 70,000

Existing EMIs

₹ 10,000

FOIR

50%

Available for New EMI

₹ 70,000 × 50% – ₹ 10,000 =

₹ 25,000

Loan Tenure

48 Months

Interest Rate

13% p.a.

Based on this, the eligible loan amount would be approximately ₹ 9.5 – ₹ 10 lakhs.

*Eligibility is not a guarantee. Eligibility will be checked based on the information you provide. The amount you can borrow (loan amount), the repayment period (tenure), and the interest rate will vary depending on your credit profile, employment info, and salary details.

Factors That Impact Your Personal Loan Eligibility

Credit Score

Your credit score reflects your repayment history. A score of 750+ improves your chances and may even fetch lower interest rates.

Tip: Check your credit report regularly to avoid surprises.

Employment Type & Employer Profile

Lenders consider job stability and employer category. Salaried employees with reputed companies are usually eligible for higher amounts.

Working in a top-tier private company or government job? You may be eligible for higher limits.

Age and Retirement Horizon

Younger borrowers have longer working years ahead, which means a longer repayment window. Typically, an age between 23–55 years is preferred.

City of Residence

Loan eligibility can vary based on the cost of living in your city. Metro residents might get a higher limit compared to Tier 2 cities, assuming higher living expenses.

Benefits of Using Personal Loan Eligibility Calculator

Instant Results

No waiting, no paperwork

Completely Free

Unlimited usage with no hidden cost

Safe & Secure

No data is stored or misused

Helps Avoid Rejection

Apply only for the amount you’re eligible for

Better Loan Planning

Adjust tenure or loan amount before applying

FAQs About Personal Loan Eligibility

Yes. You’ll need to input average monthly income from business/profession to check your eligibility.

Absolutely. Longer tenures reduce monthly EMI, which may increase your overall eligibility — but you’ll pay more in total interest.