Avail Loan Against Shares

Need funds to manage short-term expenses? Get loan against shares. It allows you to access funds quickly while holding onto your investments. Get loan against shares the same day to manage all the short term/unplanned expenses. Currently available for Demat accounts with NSDL only.

- LAS Limit on Same Day

- 10.25% p.a. Interest (on utilized amount)

- 100% Digital

Process - Large list of

approved securities

What is Loan Against Shares?

Loan against equity shares is a secured loan option. It allows you to raise instant liquidity by pledging your shares. You can access cash quickly & easily by keeping our shares as collateral.

Once the loan is approved, funds are deposited directly in your linked bank account. You pay 10.25% p.a interest on the amount you have used and only for the days you use it. When surplus fund is available, you can also make prepayment towards the utilized amount without any prepayment charges.

While you pledge your shares for the loan, you still own the stocks keep enjoying all the ownership related benefits.

Currently, you can pledge shares held in a Demat account with NSDL only.

Features & Benefits of Loan Against Shares

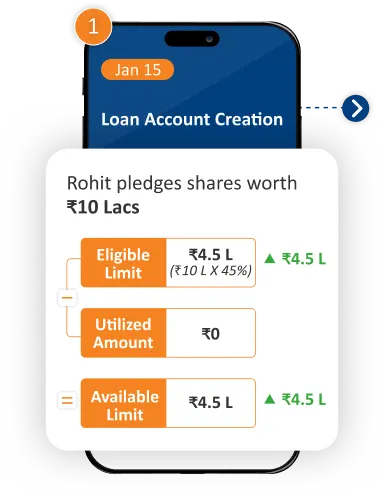

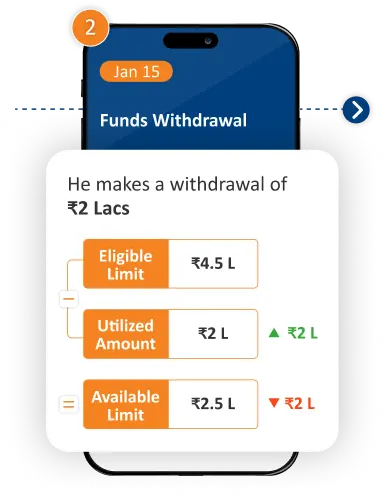

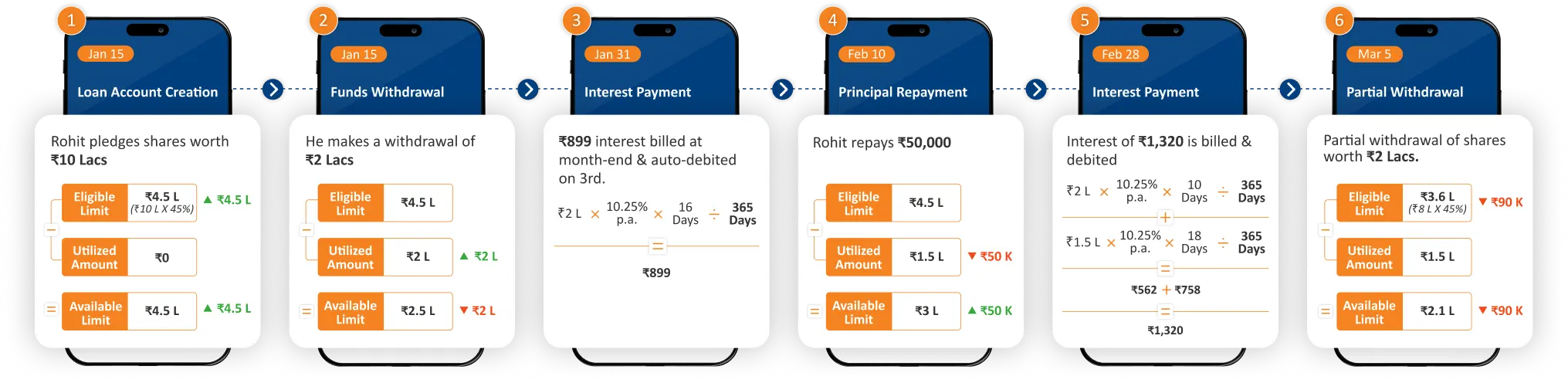

How Loan Against Shares Work?

Let’s understand this with an example.

How to Avail Loan Against Shares?

-

1Download the app or apply via web

-

2Apply for Loan Against Shares

-

3Complete one-time KYC registration with PAN & Aadhaar details

(Details will get fetched directly from Digilocker, if your Aadhaar is linked with your mobile number) -

4Pledge shares using NSDL DP ID. (Your DP will notify you once your Pledge is successful)

Please Note:- Pledge will work during working days only -

5Verify your bank account online via e-mandate

-

6Read & sign loan agreement online

-

Your loan account is ready

Loan Against Shares Details & Charges

Equity Shares

₹1,00,00,000

& renewable thereafter

+ taxes as applicable

Attention: Pledging Charges Information - Please be aware that Customers’ Depository Participant (DP) may apply pledging charges. We recommend checking with your DP to ascertain if any charges are applicable.

* Taxes as applicable

If a customer takes a loan of ₹50,000 for a period of 12 months, at an annual interest rate of 10.25% p.a., then the customer will pay monthly interest for 12 months of ₹427 per month. The total loan payment over 12 months will be ₹55,125 (including principal and interest). Total Cost of Loan = Interest Amount + Processing Fees + Stamp Duty = ₹5,125 + ₹1179 + ₹500 = ₹6,804

Things You Should Know About Loan Against Shares

Yes, you can partially depledge shares digitally without visiting a branch or any physical paperwork. If you want to replace one share with another, you will have to complete depledge of the shares via partial security withdrawal facility & add another share using top-up facility.

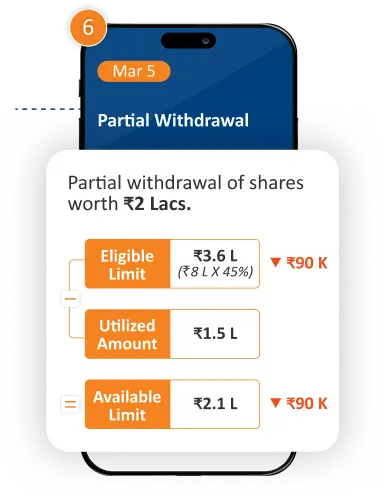

The revised eligible limit will be calculated on the basis of revised collateral value of underlying shares. Eligible limit = Collateral value x LTV%.

For partial shares depledging follow below steps

- - Login to mobile app or web.

- - Go to transaction tab and click security withdrawal.

- - Select loan account & application number under which securities are pledged.

- - Select the shares and number of shares to depledge.

- - Click calculate to check revised collateral value, revised available limit & revised total limit.

- - Verify via OTP authentication. Your request is submitted.

Your request will be reviewed and processed accordingly. The shares will be released within 24 working hours.

Note: Security withdrawal charges of Rs 500/- + Taxes will be applicable in case of partial security withdrawal. There are no charges for the foreclosure of loan account.

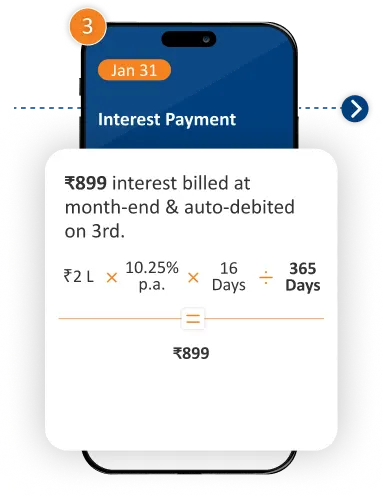

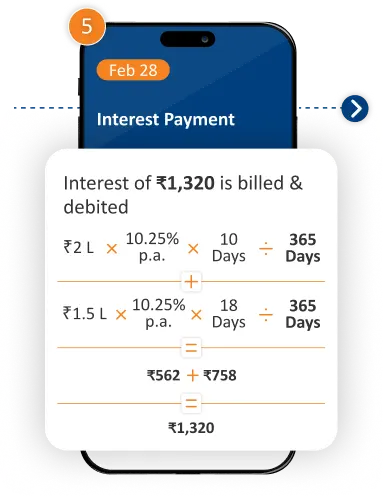

An interest rate of 10.25% p.a. is charged only on the utilized amount and for the number of days you utilize the amount. The interest is calculated on the utilized amount daily at the end of day, Interest = (utilized amount x interest rate)/ 365. The interest will be accrued till the end of month and will be due on 1st working day of every month. The same will be debited on the 3rd working day of next month from your registered Bank Account via NACH mandate. You will be notified on your registered email ID to maintain sufficient balance.

Note: Payments made via Pay Now facility will not be adjusted against the interest amount.

Example: Vijay will receive an intimation on 1st Feb 23 to maintain sufficient balance to pay interest of (10.25% x 5 x 1,00,000)/365 + (10.25% x 10 x 2,00,000)/365 + (10.25% x 5 x1,00,000)/365 = Rs.842 which will be auto-debited on the 3rd Feb 23.

At present, it is not possible to digitally lien mark or pledge Shares held with CDSL through Mirae Asset Financial Services.

An eMandate serves as a digital payment solution that enables Indian businesses to easily collect recurring payments without the need for human intervention. Mandate limit refers to the maximum permissible amount that can be deducted from the account holder's bank account through an automated payment system. However deductions on your account will only be as per actuals.

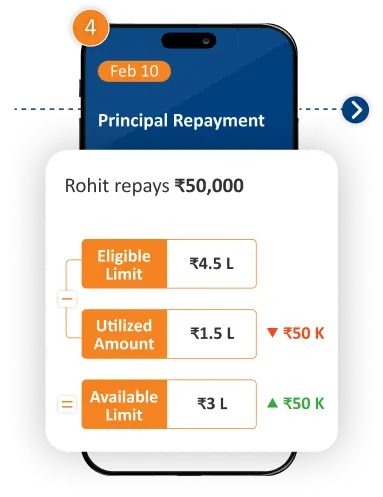

Loan against shares does not have a fixed repayment schedule or EMI for the principal amount. You can make principal repayments anytime during the loan tenure as per your convenience. You will be charged only interest on a monthly basis which will be auto debited from the registered bank account. Interest is calculated based on the utilized amount and for a number of days the amount is utilized.

If your loan account creation fails after pledging the shares, your shares will be absolutely safe and secure since the pledging happens at NSDL. You can reach customer support at 1800 2099 180 (Monday to Friday, 9am to 6pm) or write at mcare@miraeassetfin.com. The support team will either clear the issue faced or send your shares for de-pledging to NSDL.

On maturity, you have an option of renewing your loan account for further 12 months. If renewed, any principal amount utilized is carried forward to the next year. If you wish not to renew your loan account, you will be requested to repay the outstanding amount before maturity date. The utilized amount if any on maturity will become overdue and the same needs to be repaid within 7 days.

If the money is debited from the bank account and is not reflected in the loan account, the transaction may be pending at your bank. It will reflect in the loan account within 72 working hours or the amount will be refunded back to the bank account. If the transaction remains pending beyond this timeframe, please contact your bank, as the transaction is still in process on their end.

Loan Against Shares Eligibility & Documentation

- You should be a resident Indian individual

- You should have a valid PAN & Aadhaar Card

- You should have demat account with NSDL

- You should hold approved shares as per MAFS policy

- You should be between 18 to 75 years of age

- You should have a valid email ID & mobile number

- You should have a valid bank account number and internet banking access

To view, the list of approved shares click here.

Disclaimers

- Please be aware that Customers’ Depository Participant (DP) may apply pledging charges. We recommend checking with your DP to ascertain if any charges are applicable.

- Pledge will be approved only on business days.

- The Loan Against Shares is for personal use. The loan amount cannot be used for speculative activities, capital market-related purposes, or anti-social purposes.

- Credit limit is at the sole discretion of Mirae Asset Financial Services (India) Pvt Ltd.

- In case of repayment, payment is considered successful upon reflection or settlement within Mirae Asset Financial Services' system; additionally, interest will accrue (if applicable) until the settlement date.