Type Of Securities

Loan Against Mutual Funds

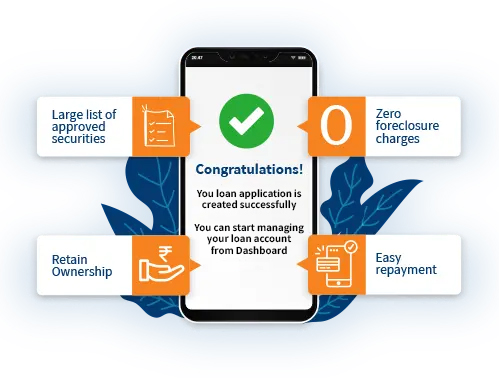

Get Loan Against Mutual Funds within minutes. Enjoy the benefit of instant availability of funds and continue to retain ownership of your mutual fund investments to achieve your long-term investment goals.

Loan Against Shares

Get Loan Against Shares the same day. Hold your shares as per your investment plan, meet your short-term to medium-term financial needs with Loan Against Shares.

- Loan Against Mutual Funds

- Loan Against Shares

Loan Against Mutual Funds

Get Loan Against Mutual Funds within minutes. Enjoy the benefit of instant availability of funds and continue to retain ownership of your mutual fund investments to achieve your long-term investment goals.

Loan Against Shares

Get Loan Against Shares the same day. Hold your shares as per your investment plan, meet your short-term to medium-term financial needs with Loan Against Shares.

What Is Loan Against Securities?

Loan against securities (LAS) is a secured loan where you can avail of the loan by pledging your securities like mutual funds and shares as collateral. LAS is provided ideal for all your short to medium-term needs.

One of the main benefits of a digital loan against securities is that it allows borrowers to access cash without selling their investments. This means they can continue to earn returns on their securities while also using them to borrow money.

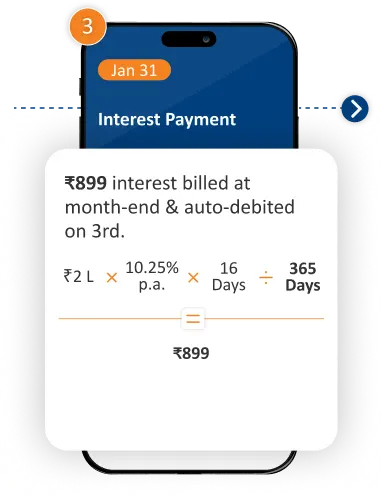

You can avail a loan against securities with Mirae Asset Financial Services at 10.25% P.A interest rate that too on utilized amount only. Avoid the hassle of visiting branches and experience 100% digital loan application process.

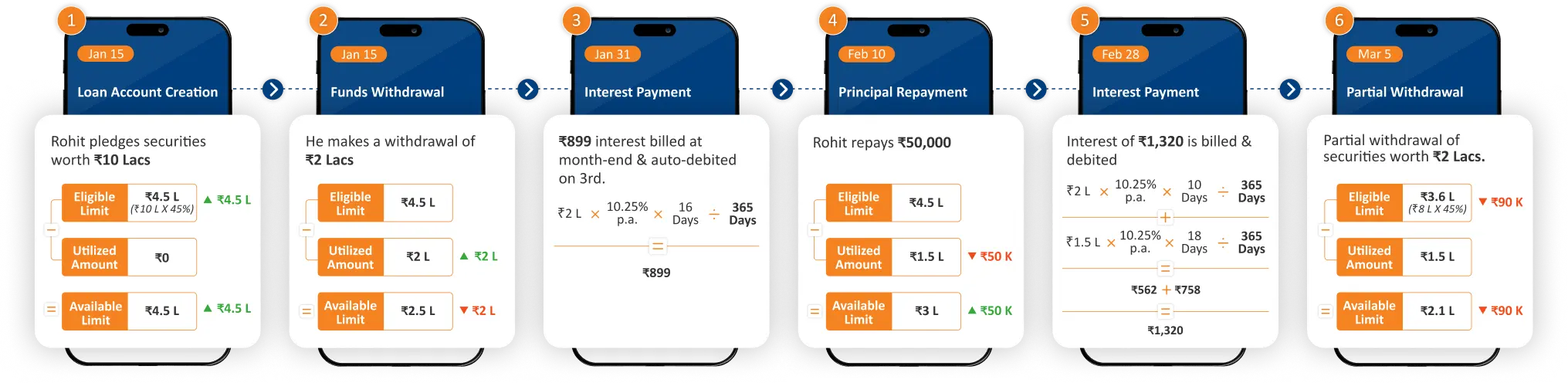

How Loan Against Securities Work?

Let’s understand this with an example.

How to Apply for a Loan Against Securities?

-

1Download the app or apply via web

-

2Select type of loan and apply

-

3Complete KYC using PAN & Aadhar details

-

4Enter bank account & additional details

-

5Pledge securities online as collateral via CAMS, KFintech or NSDL platform.

-

6Verify your bank account via Net banking/ Debit card

-

7Read & sign loan agreement online

-

Your loan account is ready

Compare Loan Features

| Mirae Asset Loan Against Securities | Personal Loans | Gold Loans | Loan Against Property | |

|---|---|---|---|---|

| Interest Rate | ||||

| Interest Rate | 10.25% p.a. (only on amount & duration utilized) | 12% p.a. Onwards | 14% p.a. Onwards | 11% p.a. Onwards |

| Type | ||||

| Type | Secured | Unsecured | Secured | Secured |

| Processing Fees | ||||

| Processing Fees | PF starting ₹999 (1 Yr: ₹999, 2 Yrs: ₹1,299, 3 Yrs: ₹1,499) | upto 2.5% of loan value + GST | upto 2% of loan value + GST | 1% - 3% of the loan amount + GST |

| Processing Time | ||||

| Processing Time | Loan against mutual funds: 15 Mins Loan against shares: Same day |

Digital Process: Instant Physical Process: 1 to 2 days |

Same day | 10 to 30 days |

| Application Process | ||||

| Application Process | End to end digital process | Both digital & physical process | Physical process only | Physical process only |

| Lock-in period | ||||

| Lock-in period | No lock-in | 6 to 12 months | No lock-in | 6 to 12 months |

| Prepayment/ Foreclosure charges | ||||

| Prepayment/ Foreclosure charges | No Charges | 2% to 4% of loan value + GST | No Charges | No Charges |

| Loan Tenure | ||||

| Loan Tenure | upto 3 Years | upto 3 Years | 1 Year | upto 20 Years |

| Loan Value | ||||

| Loan Value | Loan against equity mutual funds & shares: 1 Cr Loan against debt mutual funds: 3 Cr | upto 40 Lacs | Based on value of collateral | Based on value of collateral |

| Collateral | ||||

| Collateral | Mutual Funds & Shares | No Collateral | Gold | Property |

| LTV | ||||

| LTV | Loan against equity mutual funds & shares: 45% Loan against debt mutual funds: 80% | - | 75% to 90% | 75% to 90% |

| Income proof | ||||

| Income proof | Not Required | ITR / Salary slip required | Not Required | ITR / Salary slip required |

- This data is prepared based on available information on the web and may differ from lender to lender.

Loan Against Securities Details & Charges

Mutual Funds & Shares

₹1,00,00,000

Mutual Funds

₹3,00,00,000

Fees

* Taxes as applicable

Disclaimer: Loan accounts are reviewed periodically to assess utilisation and performance. Where required, appropriate actions may be taken in line with internal guidelines.

If a customer takes a loan of ₹50,000 for a period of 12 months, at an annual interest rate of 10.25% p.a., then the customer will pay monthly interest for 12 months of ₹427 per month. The total loan payment over 12 months will be ₹55,125 (including principal and interest). Total Cost of Loan = Interest Amount + Processing Fees + Stamp Duty = ₹5,125 + ₹1179 + ₹500 = ₹6,804

Things You Should Know About Loan Against Securities

Yes, you can partially depledge securities digitally without visiting a branch or any physical paperwork. If you want to replace one security with another, you will have to complete depledge of the security via partial security withdrawal facility & add another security using top-up facility.

The revised eligible limit will be calculated on the basis of revised collateral value of underlying securities. Eligible limit = Collateral value x LTV%.

For partial security depledging follow below steps

- - Login to mobile app or web.

- - Go to transaction tab and click security withdrawal.

- - Select loan account & application number under which securities are pledged.

- - Select the securities and number of units to depledge.

- - Click calculate to check revised collateral value, revised available limit & revised total limit.

- - Verify via OTP authentication. Your request is submitted.

Your request will be reviewed and processed accordingly. The securities will be released within 24 working hours.

Note: Security withdrawal charges of Rs 500/- + Taxes will be applicable in case of partial security withdrawal. There are no charges for the foreclosure of loan account.

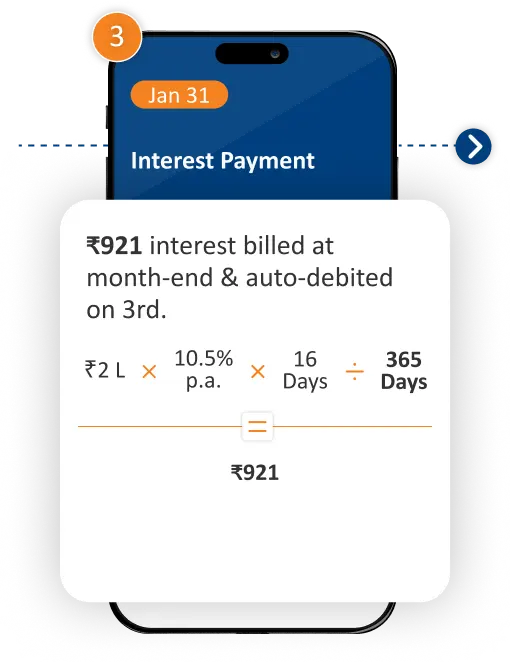

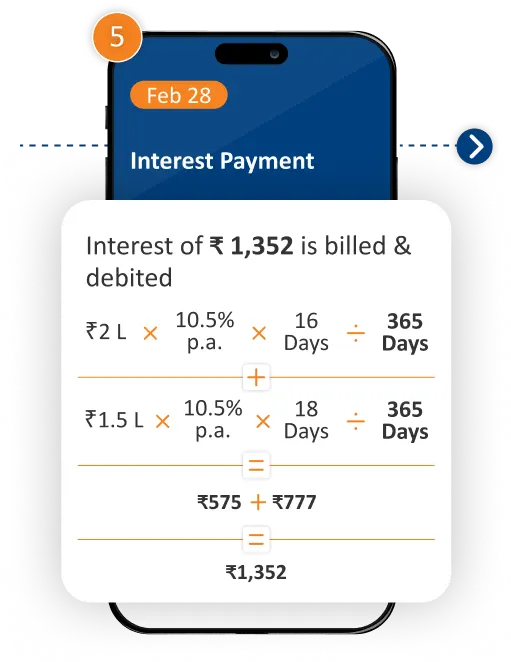

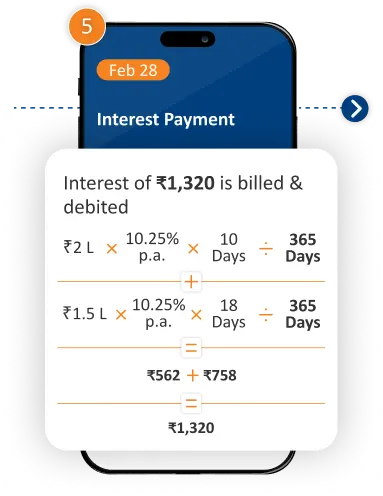

An interest rate of 10.25% p.a. is charged only on the utilized amount and for the number of days you utilize the amount. The interest is calculated on the utilized amount daily at the end of day, Interest = (utilized amount x interest rate)/ 365. The interest will be accrued till the end of month and will be due on 1st working day of every month. The same will be debited on the 3rd working day of next month from your registered Bank Account via NACH mandate. You will be notified on your registered email ID to maintain sufficient balance.

Note: Payments made via Pay Now facility will not be adjusted against the interest amount.

Example: Vijay will receive an intimation on 1st Feb 23 to maintain sufficient balance to pay interest of (10.25% x 5 x 1,00,000)/365 + (10.25% x 10 x 2,00,000)/365 + (10.25% x 5 x1,00,000)/365 = Rs.842 which will be auto-debited on the 3rd Feb 23.

At present, it is not possible to digitally lien mark or pledge Mutual Funds held in demat form through Mirae Asset Financial Services.

You may check the list of banks facilitating e-mandate process here https://www.npci.org.in/PDF/nach/live-members-e-mandates/Live-Banks-in-API-E-Mandate.pdf

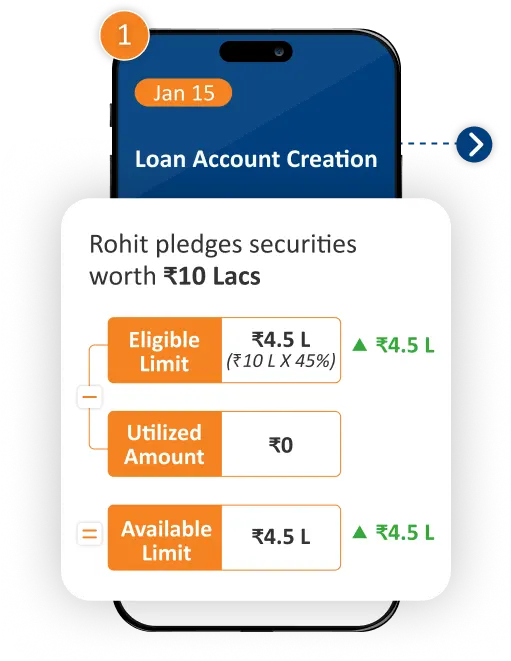

Securities value changes on a daily basis. Since the eligible limit of the loan account is dependent on the underlying collateral value (Eligible limit = collateral value x LTV%), the eligible limit of the loan account also changes as per change in collateral value. This revaluation of loan account happens on a daily basis. NAV as on previous day’s closing is considered to calculate collateral value.

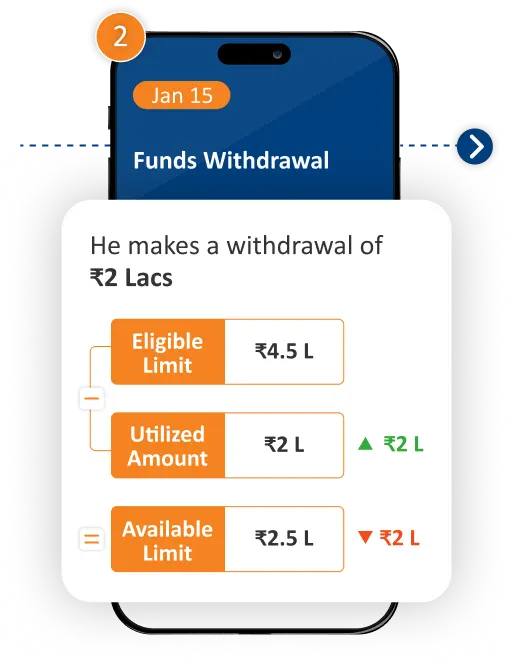

Example: Arun has availed loan against securities by lien marking or pledging securities worth Rs 10 lakhs. The eligible limit of his account is Rs 4.5 lakhs (10 lakhs x 45% LTV) (assuming an LTV of 45%). If the value of underlying securities drop to 9.5 lakhs, the revised eligible limit will drop to 4.05 lakhs (9.5 lakhs x 45% LTV).

Yes, lien marking or pledging of securities is safe. The pledging of securities happens at the RTAs (CAMs and/or Kfintech) or Depository (NSDL), firms registered with SEBI with proper authentication.

If your loan account creation fails after pledging the securities, your securities will be absolutely safe and secure since the lien marking or pledging happens at RTAs/Depository. You can reach customer support at 1800 2099 180 (Monday to Friday, 9am to 6pm) or write at mcare@miraeassetfin.com. The support team will either clear the issue faced or send your securities for de-pledging to RTAs/depository.

All dues (including interest billed & accrued, any charges, utilised amount) must be repaid before the maturity date. The loan account cannot be renewed on maturity. Any unpaid amount will become overdue on maturity and needs to be settled within 7 days from the maturity date. Penal charges will be levied on the overdue amount.

Your withdrawal request may take up to 4 working hours to process. Any request received after 5 pm and on a non-working day will be processed on the next working day.

See how to withdraw funds from your mutual fund and share loans: Watch Video.

If the money is debited from the bank account and is not reflected in the loan account, the transaction may be pending at your bank. It will reflect in the loan account within 72 working hours or the amount will be refunded back to the bank account. If the transaction remains pending beyond this timeframe, please contact your bank, as the transaction is still in process on their end.

See how to withdraw funds from your mutual fund and share loans: Watch Video.

Disclaimers

- Credit limit is at the sole discretion of Mirae Asset Financial Services (India) Pvt Ltd.

- The Loan Against Securities is for personal use. The loan amount cannot be used for speculative activities, capital market-related purposes, or anti-social purposes.

- In case of repayment, payment is considered successful upon reflection or settlement within Mirae Asset Financial Services' system; additionally, interest will accrue (if applicable) until the settlement date.