Personal Loan Interest Rate & Charges

Looking for the best personal loan interest rate? Whether it’s for a home renovation, medical emergency, travel plan, or any personal milestone, choosing the right loan interest rate and understanding the full cost of borrowing can save you thousands.

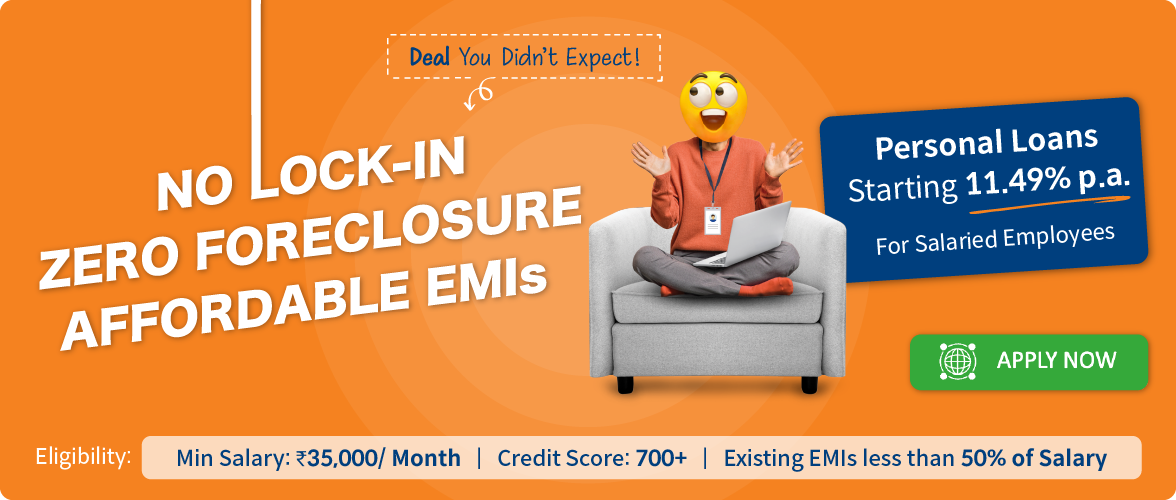

At Mirae Asset Financial Services, we make personal loans simple, affordable, and completely transparent. Enjoy low interest rates, zero hidden charges, and a fully digital application process—so you can borrow with confidence, speed, and total peace of mind. Compare rates, understand all costs upfront, and apply online in just a few clicks.

Personal Loan Interest Rate & Charges Overview

| Loan Feature | Details |

|---|---|

| Minimum Loan Amount | ₹1,00,000 |

| Maximum Loan Amount | ₹10,00,000 |

| Tenure Options | 6 to 48 Months |

| Interest Rate | From 11.49% p.a. to 19.99% p.a. (Reducing balance method) |

| Annual Percentage Rate (APR) | 13.44% p.a. to 38.07% p.a. (Includes all fees & taxes) |

| Processing Fees | 3% to 4% of loan amount (Deducted upfront from disbursal) |

| Foreclosure Charges | ZERO – No lock-in period |

| Penal Charges | 2.00% per month + taxes on overdue amount |

| Bounce Charges | ₹500 per instance |

| Bank Mandate Swap | ₹500 |

| Collection Charges | Up to ₹2,000 + taxes per instance |

| Stamp Duty | ₹200 |

| Legal Charges | On actuals (in case of default) |

Taxes as applicable

Eligibility is not a guarantee. Eligibility will be checked based on the information you provide. The amount you can borrow (loan amount), the repayment period (tenure), processing fees and the interest rate will vary depending on your credit profile, employment info, and salary details.

How to Compare Personal Loans the Right Way: Focus on Total Cost

When comparing personal loans, don’t just look at the interest rate—consider the total cost of borrowing, which includes: Interest rate, interest rate type if it’s fixed or reducing balance, processing fee, tenure, foreclosure/prepayment charges & hidden fees

Example: Comparing Two Personal Loans of ₹5,00,000 for 48 Months

| Parameter | Mirae Asset Financial Services | Lender 2 |

|---|---|---|

| Loan Amount | ₹5,00,000 | ₹5,00,000 |

| Tenure | 48 months | 48 months |

| Interest Type | Reducing Balance | Fixed |

| Interest Rate (p.a.) | 11.5% | 10.5% |

| EMI | ₹13,045 | ₹14,896 |

| Total Interest Payable | ₹1,26,136 | ₹2,14,998 |

| Processing Fee | ₹15,000 | ₹15,000 |

| Insurance Cost | ₹0 | ₹5,000 |

| Total Cost (Interest + Fee + Insurance) | ₹1,41,136 | ₹2,34,998 |

| APR (Approx.) | 13.14% | 13.97% |

| Foreclosure Charges | Zero | 4% on outstanding |

| Prepayment Charges | Zero | 4% on outstanding |

| Lock-in Period | None | 12 months |

Note: Actual EMI and interest may vary based on your credit profile, chosen tenure, and final approved interest rate.

Key Insight:

Even with a lower interest rate, Loan B gives you less money in hand, adds extra insurance costs, and limits flexibility—making it significantly more expensive in reality. With Mirae Asset Financial Services, what you see is what you get—no advance EMI, no hidden deductions, and full transparency.

Understanding Personal Loan Interest Calculation

We use the reducing balance method to calculate personal loan interest. That means you only pay interest on the outstanding principal, not the full loan amount throughout the tenure. As your principal reduces with each EMI, the interest amount also comes down.

Example: Loan of ₹1,00,000 at 12% p.a. for 12 Months

| Interest Type | Monthly EMI | Total Interest Payable | Total Repayment |

|---|---|---|---|

| Reducing Balance | ₹8,884 | ₹6,605 | ₹1,06,605 |

| Fixed Interest | ₹9,333 | ₹12,000 | ₹1,12,000 |

Notice that the total interest amount paid is less in the reducing balance method because you’re only charged interest on the outstanding loan amount—not the entire principal.

How to choose right Personal Loan tenure

Choosing personal loan tenure is a critical step, let’s understand why? As the loan tenure increases, your monthly EMI becomes lower, making it easier on your monthly budget. However, this also means you end up paying more interest over time. On the other hand, a shorter tenure results in higher EMIs, which can be financially demanding, but it helps you save significantly on interest.

That’s why it’s important to strike a balance between:

- A manageable monthly EMI, and

- Minimizing the total interest outgo.

Choose a tenure that aligns with your repayment capacity while keeping your overall cost of borrowing in check.

Here are the approximate EMI and total repayment amounts (rounded) across different loan amounts and tenure options at a starting interest rate of 11.49% p.a..

| Loan Amount | 12 Months | 24 Months | 36 Months | 48 Months | ||||

|---|---|---|---|---|---|---|---|---|

| EMI | Total Payable | EMI | Total Payable | EMI | Total Payable | EMI | Total Payable | |

| ₹1,00,000 | ₹8,847 | ₹1,06,164 | ₹4,694 | ₹1,12,654 | ₹3,289 | ₹1,18,418 | ₹2,607 | ₹1,25,118 |

| ₹2,00,000 | ₹17,694 | ₹2,12,328 | ₹9,388 | ₹2,25,308 | ₹6,578 | ₹2,36,836 | ₹5,213 | ₹2,50,236 |

| ₹3,00,000 | ₹26,541 | ₹3,18,492 | ₹14,082 | ₹3,37,962 | ₹9,867 | ₹3,55,254 | ₹7,820 | ₹3,75,354 |

| ₹4,00,000 | ₹35,388 | ₹4,24,656 | ₹18,776 | ₹4,50,616 | ₹13,156 | ₹4,73,672 | ₹10,426 | ₹5,00,472 |

| ₹5,00,000 | ₹44,235 | ₹5,30,820 | ₹23,471 | ₹5,63,270 | ₹16,445 | ₹5,92,090 | ₹13,033 | ₹6,25,590 |

| ₹6,00,000 | ₹53,082 | ₹6,36,984 | ₹28,165 | ₹6,75,924 | ₹19,734 | ₹7,10,508 | ₹15,639 | ₹7,50,708 |

| ₹7,00,000 | ₹61,929 | ₹7,43,148 | ₹32,859 | ₹7,88,578 | ₹23,023 | ₹8,28,926 | ₹18,246 | ₹8,75,826 |

| ₹8,00,000 | ₹70,776 | ₹8,49,312 | ₹37,553 | ₹9,01,232 | ₹26,312 | ₹9,47,344 | ₹20,852 | ₹10,00,944 |

| ₹9,00,000 | ₹79,623 | ₹9,55,476 | ₹42,247 | ₹10,13,886 | ₹29,601 | ₹10,65,762 | ₹23,459 | ₹11,26,062 |

| ₹10,00,000 | ₹88,470 | ₹10,61,640 | ₹46,943 | ₹11,26,540 | ₹32,890 | ₹11,84,180 | ₹26,066 | ₹12,51,180 |

Note: Actual EMI and interest may vary based on your credit profile, chosen tenure, and final approved interest rate.

What Happens If You Make a Part Prepayment on Your Personal Loan?

A part prepayment means you pay a lump sum towards your loan before the scheduled end of your tenure, without fully closing the loan. This can significantly reduce your interest burden and help you repay your loan faster.

How Does Part Prepayment Work?

When you make a part prepayment:

- The amount is directly deducted from your outstanding principal.

- Since interest is charged on the remaining principal (under the reducing balance method), your future EMIs will have lower interest.

- Your EMI remains the same and we reduce your loan tenure.

Example: Let’s say you have taken a personal loan of ₹5,00,000 at an interest rate of 12% p.a. for a tenure of 48 months.

- Your regular EMI: ₹13,167

- Total Interest Payable: ₹1,32,000

- Total Repayment: ₹6,32,000

Let’s say you make a part prepayment of ₹1,00,000 after 12 months of regular EMI payments. We apply this amount directly towards your outstanding principal, while keeping your EMI amount unchanged.

- New EMI: ₹13,167

- New Tenure: 36 months

- Total interest payable: ~ ₹1,05,965

- Interest Saved: ₹32,000

- Total Repayment: ₹6,00,000

As a result:

- Your loan tenure gets reduced, so you’ll repay the loan faster

- Your total interest payout decreases, helping you save more over the life of the loan

In simple terms, you become debt-free sooner and pay less interest than what was originally planned when you took the loan.

What Happens If You Foreclose the Loan After 12 Months?

Foreclosure is when you choose to close your personal loan early by paying off the full remaining balance in one go. It helps you save on interest and become debt-free faster—and with Mirae Asset Financial Services, you can do it anytime with zero extra charges.

Let’s say you have taken a personal loan of ₹5,00,000 at an interest rate of 12% p.a. for a tenure of 48 months.

- Your regular EMI: ₹13,167

- Total Interest Payable: ₹1,32,000

- Total Repayment: ₹6,32,000

- Total Interest (if paid full term): ~₹1,32,000

- Total Repayment (if paid full term): ₹6,32,000

Foreclosure After 12 EMIs, Now, you decide to foreclose by paying the remaining principal in one go. After 12 months:

- You’ve paid: ₹1,58,004 (₹13,167 × 12 EMIs)

- Out of that, around ₹48,000 went toward interest

- Your remaining principal is ~₹3,90,000

- Total Repayment: ₹5,48,004

- Interest Saved: ₹83,996

You save over ₹83,000 in interest by foreclosing after 12 months.

FAQs – Personal Loan Interest Rate & Charges

No. We offer zero foreclosure charges with no lock-in period.

All our fees—processing, penal, bounce, and collection—are clearly disclosed. There are no hidden charges.