Understanding FOIR and Its Impact on Your Personal Loan Application

Introduction

When you apply for a personal loan, one of the key factors lenders evaluate is your Financial Obligations to Income Ratio (FOIR). It plays a significant role in determining whether you are eligible for a loan, and if so, how much you can borrow. In this blog, we will explain what FOIR is, how it affects your loan eligibility, and what you can do to improve it.

What is FOIR?

FOIR, or Financial Obligations to Income Ratio, is a metric used by lenders to assess a borrower’s capacity to repay a loan. It compares your total monthly financial obligations (existing debts, loan EMIs, credit card payments, etc.) to your monthly income. Lenders use FOIR to evaluate how much of your income is already being used to fulfill existing financial commitments and whether you can manage additional loan repayment without overburdening yourself.

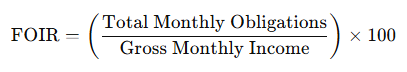

The formula for calculating FOIR is:

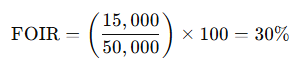

For example, if you have a monthly income of ₹50,000 and monthly obligations (EMIs, credit card payments) of ₹15,000, your FOIR would be:

This means that 30% of the borrower’s monthly income goes towards paying existing debts. Lenders will consider this ratio when evaluating the borrower’s ability to handle additional loan payments.

How Does FOIR Affect Your Loan Amount?

FOIR is a critical factor in determining the loan amount a borrower can be approved for. Lenders usually have a limit on the FOIR, beyond which they may not approve a loan. A common FOIR limit is 70%, meaning that a borrower’s total financial obligations (including the new loan EMI) should not exceed 70% of their monthly income.

Let’s say you have a FOIR of 40%, and you are applying for a personal loan. The lender might have a policy of not approving loans for borrowers with a FOIR above 70%. So, if your FOIR is at 40%, and the lender wants to keep it at 70%, they will approve a loan up to a limit that increases your FOIR to a maximum of 70%.

For Example:

- Your monthly income: ₹50,000

- Current monthly obligations: ₹20,000 (FOIR = 40%)

- Maximum allowable FOIR: 70% (₹35,000)

In this case, the lender will give you an additional loan amount, but the total EMIs (old + new) should not exceed ₹35,000. If your current EMIs are ₹20,000, they may approve an EMI of ₹15,000 for the new loan, ensuring that your FOIR remains at 70%.

How to Improve FOIR

If you want to increase your chances of getting a larger loan or a better interest rate, it’s essential to improve your FOIR. Here are some ways to do so:

- Reduce Existing Debt: Pay off existing loans or credit card bills to lower your monthly obligations. This will directly reduce your FOIR and improve your loan eligibility.

- Get Lower-Interest Debt: If possible, consolidate high-interest debts into a lower-interest loan. This will reduce your monthly obligations and help lower your FOIR.

- Increase Income: Consider finding ways to increase your monthly income, such as taking on a side job, asking for a raise, or investing in skill development to enhance your career prospects.

Benefits of Maintaining a Healthy FOIR

Maintaining a healthy FOIR can have multiple benefits, including:

- Better Loan Approval Chances: A lower FOIR means you are less financially strained, which increases your chances of loan approval. It demonstrates to lenders that you can handle additional financial obligations.

- Higher Loan Amounts: With a healthier FOIR, you may be eligible for a higher loan amount since lenders know you can comfortably handle the increased EMI burden.

- Better Interest Rates: Lenders may offer you more competitive interest rates if your FOIR is low, as it indicates lower financial risk for them.

- Improved Financial Stability: A balanced FOIR reflects good financial management and can contribute to overall financial stability.

Conclusion:

In conclusion, understanding and managing your FOIR is essential for personal loan applications. It determines how much of a loan you can qualify for and plays a critical role in your financial health. By reducing your existing debt, improving your income, and managing your finances wisely, you can maintain a healthy FOIR that ensures better loan approval chances, higher amounts, and more favorable interest rates. Always keep your FOIR in check and use it as a tool to maintain financial balance.