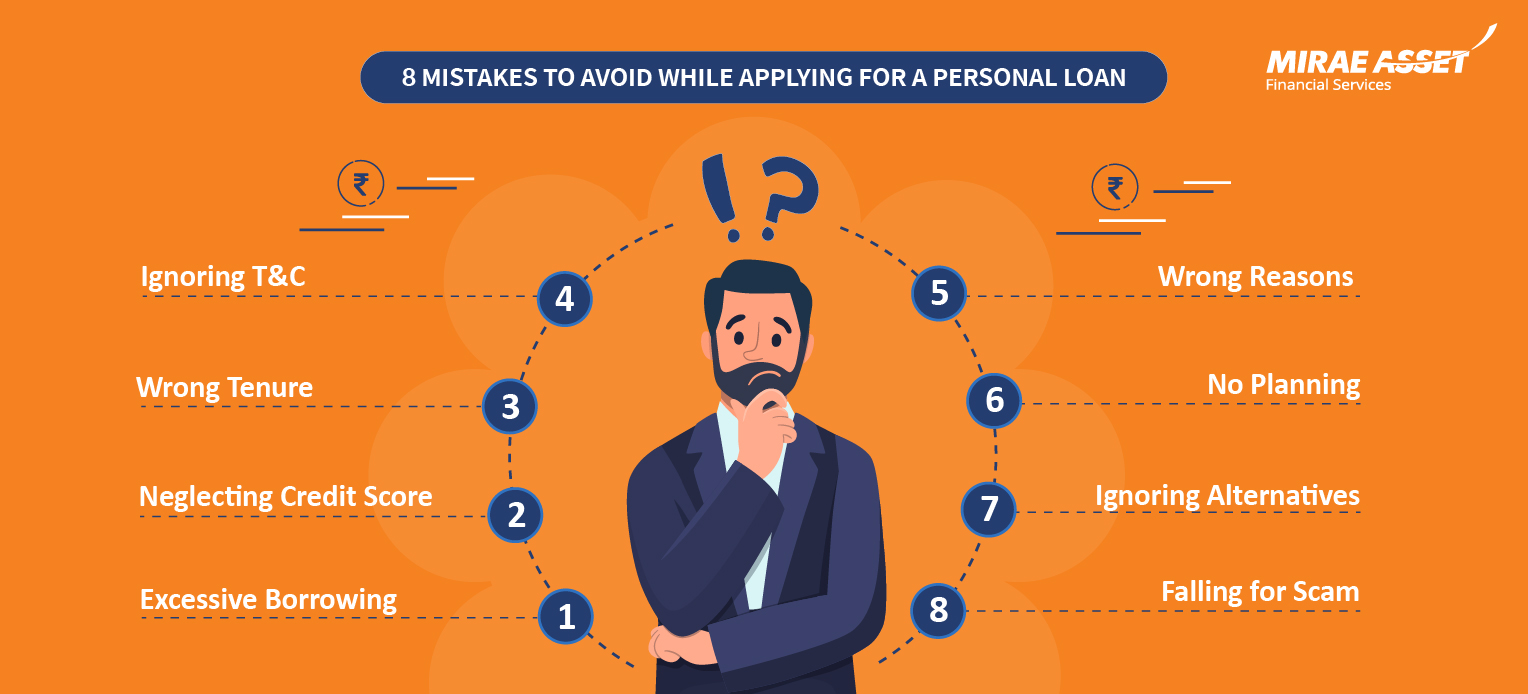

8 Mistakes To Avoid While Applying For A Personal Loan.

Digital innovation and infrastructure have streamlined the process of accessing funds for borrowers, making it quicker and more convenient. However, with this increased accessibility comes a heightened risk of errors during the loan application process. Therefore, it is crucial for borrowers to thoroughly understand the terms and conditions of the loan they are applying for before proceeding with their application.

Let's understand the common mistakes made by borrowers while applying for a loan:

1. Borrowing Excessively:

While it might be tempting to take out more money than you actually need, keep in mind that you'll have to pay it back with interest. Calculate your expenses precisely and borrow only what is necessary. It's wise to have a clear budget in mind before taking out a loan.

2. Neglecting to Check Your Credit Score:

Lenders evaluate your credit history when considering your loan application. Failing to review your credit score beforehand could result in higher interest rates or even rejection of your application. Check your credit score and take steps to improve it if necessary, before applying for a loan. A higher credit score can help you secure better interest rates.

3. Overlooking Alternative Options:

Interest rates can vary significantly among lenders. Without comparing loan options from different sources, you might miss out on more affordable choices and end up paying higher borrowing costs. Research and compare loan options from multiple lenders to find the best terms and interest rates. Use online comparison tools and consult with financial advisors if needed.

4. Disregarding Terms and Conditions:

Many borrowers skip over the terms and conditions, dismissing them as lengthy and unappealing. However, overlooking these details could lead to trouble down the line, as important information might be overlooked. Take the time to carefully read and understand all terms and conditions of the loan agreement. If something is unclear, don't hesitate to ask the lender for clarification.

5. Borrowing for Inappropriate Reasons:

It's essential to have a clear purpose for taking out a loan. Using borrowed money for speculative investments or luxury purchases can lead to repayment difficulties later on. Ensure that the purpose of the loan aligns with your financial goals and needs. Avoid using the loan for speculative or frivolous activities that could lead to financial trouble.

6. Lack of a Repayment Strategy:

Before obtaining a loan, it's crucial to have a solid plan in place for repaying the borrowed amount along with interest and any associated charges. Missing out on your payments has its own repercussions. Create a detailed repayment plan that outlines how you will pay off the loan, including budgeting for monthly payments and accounting for any additional charges or fees.

7. Selecting the Wrong Loan Term:

The loan tenure directly affects your Equated Monthly Instalment (EMI). Opting for a shorter loan tenure could result in EMIs that exceed your financial capacity. Select a loan tenure that matches your financial capabilities and ensures affordable EMIs. Consider factors such as your income stability and future financial obligations when deciding on the loan tenure.

8. Falling Victim to Scams:

Falling for fraudulent apps or schemes could result in exorbitant fees and interest payments. This may lead you to face unnecessary harassment from recovery agents. Applying for loans only through registered entities regulated by the RBI is crucial. Be cautious of offers that seem too good to be true and always verify the legitimacy of the lender before proceeding with the loan application.

TO GET STARTED WITH YOUR PERSONAL LOAN APPLICATION

In conclusion, applying for a personal loan can be a significant financial decision, and avoiding common mistakes is crucial to ensure a smooth borrowing experience. Ultimately, by following these guidelines and tips, borrowers can complete the loan application process confidently, securing the funds they need while minimizing financial risks and maximizing benefits.